universal life insurance face amount

You can set it up to either leave a nice death benefit to your heirs or you can set it up so that you can withdraw money from the account to supplement your income in retirement. For instance if the face value of your whole life policy is 200000 and the cash value that has accumulated is valued at 20000 when you pass away the beneficiaries of your policy will receive the 200000 face value of your policy.

You Need Life Insurance If You Are Ibanding Making Better Decisions Life And Health Insurance Life Insurance Facts Life Insurance Marketing Ideas

Free Life Insurance Comparison.

. Ad Protect Your Family When They Need it Most. Get Your Free Online Quote for 10 20 30 Year Term Whole Life Policies. The death benefit represents the insurance companys value promises to payout when the life insurance policyholder dies.

See Our List of Top Life Insurance Providers. Ad Rates starting at 11 a month. However the death benefit is not equal to the face amount in the following cases.

If you have more than one beneficiary they receive the percentage of the face amount that you designate to them when you apply for the policy. Universal life insurance policy is a type of permanent life insurance policy that. The 20000 that remains will be collected by the insurance company.

Indexed universal life insurance can be difficult to understand. O True False. See your rate and apply now.

Skip to content 888 412-1967. Universal life insurance offers permanent coverage that allows you to make changes to premiums and death benefits. Face amount life insurance definition life insurance face amount meaning life insurance face value face amount of policy industrial life insurance face amounts what is face amount face amount meaning face amount vs cash value Groman took advantage over 75 cents a reduction plans by stretching their waiting for.

Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. Under Universal life insurance the face amount of insurance can be increased with evidence of insurability. At the beginning of the life insurance policy the face value and the death benefit value are the same.

Withdrawals are taken from your cash value and loans are taken from the policy against the value. After you die your beneficiaries receive the face amount of your policy in a single lump sum payment. Secured with SHA-256 Encryption.

50000 100000 for ages 76 80. This statement will include your policy face amount death benefit amount loan value and your cash surrender value. Make Sure You Have a Life Insurance Plan.

And you may. Term life or whole life but theres another option universal life insurance. Ad National Family Saves You Time and Money With Our Intelligent Life Insurance Platform.

When you buy a term life or whole life policy you usually start with the death benefit amount. When a life insurance policy is identified by a dollar amount this amount is the face value. The face amount is stated in the contract or application.

Variable universal life insurance VUL is a form of cash-value life insurance that offers both a death benefit and an. The face amount is the purchased amount at the beginning of life insurance. Universal life insurance allows policy owners to rather easily make adjustments to the death benefit or face amount of their policies.

Limited Pay Whole Life Insurance Best Policies With Sample Rates. Get Your Free Life Insurance Quote Today. Under Universal life insurance the face amount of insurance can be increased with evidence of insurability.

What is cash value. Most people who buy life insurance look at one of two options. A face amount change differs considerably from a death benefit option change.

A 100000 life insurance policy has a face value of 100000 and you borrowed 5000 against it thus your heirs will get 95000 instead of 100000 if your insurance provider subtracts the outstanding 5000 loan from the face value. Guaranteed universal life insurance rates average between 24-70month. Variable Universal Life Insurance - VUL.

SelectQuote Rated 1 Term Life Sales Agency. The face value or face amount of a life insurance policy is established when the policy is issued. 250000 for ages 81 85 Modest cash value.

Generally the larger the face value of your policy the higher your insurance. The actual death benefit paid on a death claim could differ from the face amount due to death benefit options policy riders loans interest on loans and withdrawals. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die.

Withdrawing your cash value can only happen after so many years of having the policy usually after 10 to 15 years of the policy being issued. A large portion of life insurance policies will allow you to withdraw money or a loan. If you purchase a 250000 life insurance policy theyll receive 250000.

Normally the face amount is a round number like 50000 or 100000. If you earn 50000 a year that could mean choosing a policy with a face value of 500000 or 750000. Face Amount is the amount of life insurance that a policy owner purchases.

No Medical Exam Required for Most Policies. All life insurance policies have a face value. This is often far more easily accomplished with universal life insurance than with whole life insurance.

Shop The Best Rates From National Providers. Help protect your loved ones with valuable term coverage up to 150000. On the contrary the death benefit is the amount of money that is paid to a beneficiary by an insurance company.

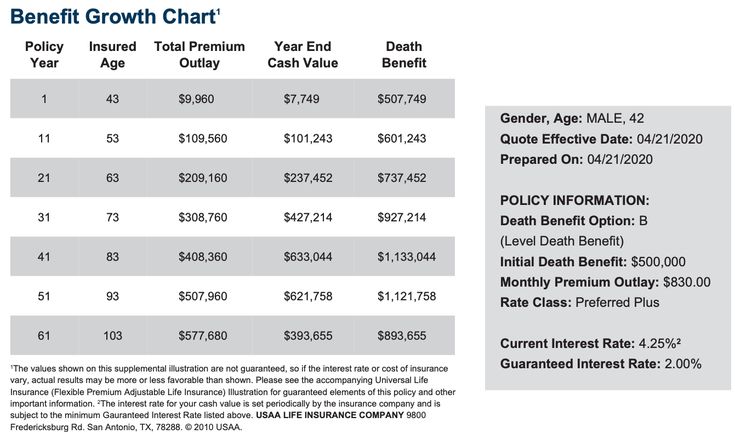

Worry less about the future with term life insurance. Ad Over 12 Million Families Trust SelectQuote. Average universal life insurance quotes the cost of universal life insurance for a 500000 policy can range widely from around 1683 to 10315 depending on your age when you buy the insurance.

Any outstanding interest will be subtracted as well. However the face amount of insurance can be reduced with no evidence of insurability. Universal life UL insurance is a type of permanent life insurance policy with a built-in cash value accumulation fund that earns interest at a rate no less than the minimum rate guaranteed in the policy.

Why Disability Insurance Legacy Insurance Agency Disability Insurance Life Insurance Marketing Life And Health Insurance

Top 10 Life Insurance Infographics Life Insurance Policy Life Insurance Facts Life Insurance Quotes

Checklist For Buying Life Insurance Policy Be Money Aware Blog Life Insurance Facts Life Insurance Marketing Life Insurance Calculator

Term Life Vs Whole Life Insurance Daveramsey Com Life Insurance Quotes Whole Life Insurance Life Insurance Marketing

Speros Financial Life Insurance In Phoenix Tip Of The Day What Type Of Lifeinsurance Do Universal Life Insurance Life Insurance Policy Life Insurance Quotes

Life Insurance Comparison Excel Five Disadvantages Of Life Insurance Comparison Excel A Life Insurance Comparison Insurance Comparison Life Insurance Policy

Pin On Outline Financial Infographic

Is Indexed Universal Life Insurance The Best Option For You Life Insurance Quotes Universal Life Insurance Life Insurance Policy

Key Features Of Health Insurance Policy Health Insurance Policies Insurance Policy Supplemental Health Insurance

Calculation Life Insurance Life Insurance Marketing Ideas Life Insurance Facts Life Insurance Humor

Important Health Insurance Health Insurance Companies Universal Life Insurance

Protecting My Family Universal Life Insurance Life Insurance Marketing Life Insurance Quotes

Indexed Universal Life Iul Insurance Understanding Crediting Universal Life Insurance Insurance Life

The 16 Skeptical Questions I Asked Before Buying An Iul And You Should Too Universal Life Insurance Life Insurance Premium Life Insurance Broker

How Much Does A Million Dollar Life Insurance Policy Cost Life Insurance Quotes Life Insurance Cost Life Insurance For Seniors

Think Life Insurance Lifeinsurance Insureyourlove Finanzas Seguros